Published - 20 days ago | 7 min read

Agentic AI in Finance: Engineering Autonomous Revenue Engines for 2026

Financial institutions in 2025 face a critical pivot point: the shift from Generative AI (tools that summarize text) to Agentic AI (autonomous systems that execute work). According to an MIT Technology survey, 70% of banks are now piloting or deploying agentic AI (52% piloting, 16% production), yet the majority struggle to scale beyond the pilot phase. The barrier is the legacy infrastructure that traps data in silos.

This guide is designed for CTOs, CFOs, and Fintech Leaders. It outlines:

The Architecture: How to securely bridge Large Language Models (LLMs) with COBOL/SQL cores using microservices.

The ROI: Why agentic workflows are reducing financial close times by 30-50% in early pilots.

The Roadmap: A structured 90-day plan to move from experimental pilot to enterprise production.

Governance: The specific "Kill Switch" and "Human-in-the-Loop" patterns required for regulatory safety.

This guide is designed for CTOs, CFOs, and Fintech Leaders. It outlines:

The Architecture: How to securely bridge Large Language Models (LLMs) with COBOL/SQL cores using microservices.

The ROI: Why agentic workflows are reducing financial close times by 30-50% in early pilots.

The Roadmap: A structured 90-day plan to move from experimental pilot to enterprise production.

Governance: The specific "Kill Switch" and "Human-in-the-Loop" patterns required for regulatory safety.

The Scaling Challenge: Moving Beyond "Chat"

Successful AI adoption in the financial sector now relies on "Data Orchestration," the engineering discipline of connecting AI models securely to private financial data.

As we move through 2025, the market has shifted fundamentally. The "Chatbot Era" is over. The clear winners are institutions deploying Autonomous AI Agents that don't just talk, but act.

For CTOs and Product Managers, the primary objective is integration. A scalable system requires seamless connectivity between the reasoning capabilities of modern AI and the rigid, transactional nature of legacy mainframes.

Industry Benchmark: McKinsey reports that intelligent autonomy deployments are driving 60-90% time-to-resolution reductions for autonomous agents, and improving end-to-end efficiency by 30%, as per Deloitte. Similarly, Deloitte projects that agentic AI will help save between 20% and 40% in software investments for the banking industry by 2028.

As we move through 2025, the market has shifted fundamentally. The "Chatbot Era" is over. The clear winners are institutions deploying Autonomous AI Agents that don't just talk, but act.

For CTOs and Product Managers, the primary objective is integration. A scalable system requires seamless connectivity between the reasoning capabilities of modern AI and the rigid, transactional nature of legacy mainframes.

Industry Benchmark: McKinsey reports that intelligent autonomy deployments are driving 60-90% time-to-resolution reductions for autonomous agents, and improving end-to-end efficiency by 30%, as per Deloitte. Similarly, Deloitte projects that agentic AI will help save between 20% and 40% in software investments for the banking industry by 2028.

Defining the Agentic Shift: From Retrieval to Execution

Agentic AI agents represent the evolution of artificial intelligence from simple information retrieval to complex task execution.

To understand where capital is being deployed, stakeholders must distinguish between the "Librarian" and the "Worker."

Generative AI (The Librarian): Reads a PDF, summarizes earnings calls, or drafts an email. It is useful, but passive. It waits for a human to prompt it.

Agentic AI (The Worker): Verifies a user's ID, checks their ledger balance, calculates a risk score, and approves a transaction. It is active, autonomous, and goal-oriented.

To understand where capital is being deployed, stakeholders must distinguish between the "Librarian" and the "Worker."

Generative AI (The Librarian): Reads a PDF, summarizes earnings calls, or drafts an email. It is useful, but passive. It waits for a human to prompt it.

Agentic AI (The Worker): Verifies a user's ID, checks their ledger balance, calculates a risk score, and approves a transaction. It is active, autonomous, and goal-oriented.

Strategic Vectors: 3 High-Value Use Cases for AI Agents in Banking

We see aggressive development activity in three specific "vectors" where automation directly impacts liquidity and revenue. These are not theoretical; they are where the budget is moving in 2025.

1. The "Self-Healing" FP&A Ledger

Generative AI for financial forecasting is moving FP&A from a monthly reporting cadence to a live operational view.

- The Function: Custom SQL-to-Text models (utilizing architectures like DeepSeek or Llama 3) continuously monitor cash flow variances and accounts payable.

- The Payoff: Instead of discovering a vendor price hike at month-end, the AI flags it instantly. It runs scenario modeling: "Price increase reduces Q3 margin by 0.2%. Recommendation: Switch to Supplier B or renegotiate terms." This transforms the ledger from a record of the past into a map of the future.

- The Function: Custom SQL-to-Text models (utilizing architectures like DeepSeek or Llama 3) continuously monitor cash flow variances and accounts payable.

- The Payoff: Instead of discovering a vendor price hike at month-end, the AI flags it instantly. It runs scenario modeling: "Price increase reduces Q3 margin by 0.2%. Recommendation: Switch to Supplier B or renegotiate terms." This transforms the ledger from a record of the past into a map of the future.

2. Intelligent Document Processing (IDP) at Scale

Processing unstructured data (tax returns, legal agreements, invoices) remains the costliest bottleneck in lending and compliance.

- The Tech: Multi-Modal AI pipelines ingest PDFs and Images simultaneously, understanding layout as well as text.

- The Metric: In pilot programs, banks utilizing Agentic IDP are seeing 50-70% reductions in manual data entry costs. By freeing analysts from data entry, institutions can redeploy talent toward risk assessment and relationship management.

- The Tech: Multi-Modal AI pipelines ingest PDFs and Images simultaneously, understanding layout as well as text.

- The Metric: In pilot programs, banks utilizing Agentic IDP are seeing 50-70% reductions in manual data entry costs. By freeing analysts from data entry, institutions can redeploy talent toward risk assessment and relationship management.

3. Hyper-Personalized "Lifestyle" Banking

Banks are using agentic AI agents to move from broad customer "Segments" to "Individuals."

- The Use Case: An agent detects a pattern of spending on nursery furniture and medical co-pays.

- The Action: Instead of sending a generic credit card offer, the agent proactively spins up a "College Savings Goal" in the app, calculates the monthly contribution needed to reach a target in 18 years, and presents a "One-Click Setup." This shifts the bank's role from a utility provider to a proactive financial partner.

- The Use Case: An agent detects a pattern of spending on nursery furniture and medical co-pays.

- The Action: Instead of sending a generic credit card offer, the agent proactively spins up a "College Savings Goal" in the app, calculates the monthly contribution needed to reach a target in 18 years, and presents a "One-Click Setup." This shifts the bank's role from a utility provider to a proactive financial partner.

Architecture: Secure Integration with Legacy Cores

The #1 blocker for Fintechs is the "Spaghetti Architecture" of legacy systems. You cannot plug an LLM directly into a mainframe.

Integrating a probabilistic AI model into a deterministic banking environment requires a "Security-First" architecture. We utilize a 3-layer microservices stack to solve this.

Integrating a probabilistic AI model into a deterministic banking environment requires a "Security-First" architecture. We utilize a 3-layer microservices stack to solve this.

Layer 1: The API Wrapper (The Safety Valve)

Direct database access is a security risk. We build a Microservices Wrapper that exposes only specific, authorized endpoints (e.g., check_balance, freeze_card, get_transaction_history).

Why it matters: The AI Agent interacts with this layer, never the root database. This ensures the agent can perform tasks without having permission to corrupt the core ledger or access unauthorized data fields.

Why it matters: The AI Agent interacts with this layer, never the root database. This ensures the agent can perform tasks without having permission to corrupt the core ledger or access unauthorized data fields.

Layer 2: Vector Database Implementation (The Context Engine)

We run a Vector Database (such as Pinecone, Milvus, or Weaviate) alongside your SQL core.

- SQL Role: Stores the numbers (e.g., Transaction ID: 123, Amount: $50.00).

- Vector Role: Stores the context and meaning (e.g., "Client dinner in Tokyo," "Recurring subscription").

This dual-database approach allows the AI to answer semantic queries like "How much did I spend on client entertainment last quarter?" that a standard SQL query cannot easily resolve.

- SQL Role: Stores the numbers (e.g., Transaction ID: 123, Amount: $50.00).

- Vector Role: Stores the context and meaning (e.g., "Client dinner in Tokyo," "Recurring subscription").

This dual-database approach allows the AI to answer semantic queries like "How much did I spend on client entertainment last quarter?" that a standard SQL query cannot easily resolve.

Layer 3: Private Cloud Deployment (The Compliance Shield)

Public APIs are often a non-starter for enterprise compliance. We deploy open-weights models directly into your AWS VPC, Azure, or Google Cloud environment.

- The Benefit: Your customer data never leaves your perimeter. This ensures full alignment with GDPR, CCPA, and SOC2 requirements, as no data is trained on external vendors' models.

- The Benefit: Your customer data never leaves your perimeter. This ensures full alignment with GDPR, CCPA, and SOC2 requirements, as no data is trained on external vendors' models.

Regulatory Safety & Governance: The "Kill Switch" Framework

In 2025, "Hallucinations" are not a bug; they are a liability. Governance must be engineered into the code.

We do not rely on prompt engineering alone to secure financial AI. We build Deterministic Guardrails using engineering patterns that satisfy risk and compliance teams.

We do not rely on prompt engineering alone to secure financial AI. We build Deterministic Guardrails using engineering patterns that satisfy risk and compliance teams.

The 3 Essential Governance Patterns

Pattern 1: The "Kill Switch" & Circuit Breakers

Automated agents must have limits. If an Agent attempts a transaction above a certain threshold (e.g., $10,000) or with an anomaly score > 0.8, the system automatically "trips the circuit." The workflow freezes and is routed to a human manager for manual review. This prevents "runaway" agent behavior.

Pattern 2: Role-Based Access Control (RBAC)

Just like a human employee, the AI Agent has a digital "Badge." It is granted least-privilege access. An agent designed for "Customer Service" might have Read-Only access to the ledger but is strictly blocked from executing Write commands. This segmentation minimizes the blast radius of any potential error.

Pattern 3: Immutable Audit Trails & Observability

Every "thought" the AI has is logged. We utilize Observability Pipelines to record the Input, the Reasoning Step (Chain of Thought), the Tool Call, and the Output.

- Why it matters: This ensures 100% forensic traceability. If an auditor asks why a loan was approved, you can produce a log showing the exact document and logic the AI used to make the decision.

Automated agents must have limits. If an Agent attempts a transaction above a certain threshold (e.g., $10,000) or with an anomaly score > 0.8, the system automatically "trips the circuit." The workflow freezes and is routed to a human manager for manual review. This prevents "runaway" agent behavior.

Pattern 2: Role-Based Access Control (RBAC)

Just like a human employee, the AI Agent has a digital "Badge." It is granted least-privilege access. An agent designed for "Customer Service" might have Read-Only access to the ledger but is strictly blocked from executing Write commands. This segmentation minimizes the blast radius of any potential error.

Pattern 3: Immutable Audit Trails & Observability

Every "thought" the AI has is logged. We utilize Observability Pipelines to record the Input, the Reasoning Step (Chain of Thought), the Tool Call, and the Output.

- Why it matters: This ensures 100% forensic traceability. If an auditor asks why a loan was approved, you can produce a log showing the exact document and logic the AI used to make the decision.

Strategic Asset Ownership: The Case for Custom Development

Build vs. Buy? In AI, "Buying" often means renting your competitor's advantage.

Institutions evaluating their AI strategy often face the dilemma of buying a SaaS wrapper or building a custom module. While SaaS offers a quick start, building custom infrastructure offers significant long-term strategic value.

- Asset Valuation: The AI models and workflows you build become proprietary IP. This contributes directly to the company's valuation, rather than being a rented expense on a P&L.

- Model Agnosticism: The AI landscape changes monthly. Custom systems allow for the interchangeability of underlying models. If GPT-6 is too expensive or slow, we can swap in Llama 4 or DeepSeek without rebuilding your entire application.

- Lower TCO: High-volume fintechs can reduce operational costs by owning the compute rather than paying per-token API fees to a vendor.

Institutions evaluating their AI strategy often face the dilemma of buying a SaaS wrapper or building a custom module. While SaaS offers a quick start, building custom infrastructure offers significant long-term strategic value.

- Asset Valuation: The AI models and workflows you build become proprietary IP. This contributes directly to the company's valuation, rather than being a rented expense on a P&L.

- Model Agnosticism: The AI landscape changes monthly. Custom systems allow for the interchangeability of underlying models. If GPT-6 is too expensive or slow, we can swap in Llama 4 or DeepSeek without rebuilding your entire application.

- Lower TCO: High-volume fintechs can reduce operational costs by owning the compute rather than paying per-token API fees to a vendor.

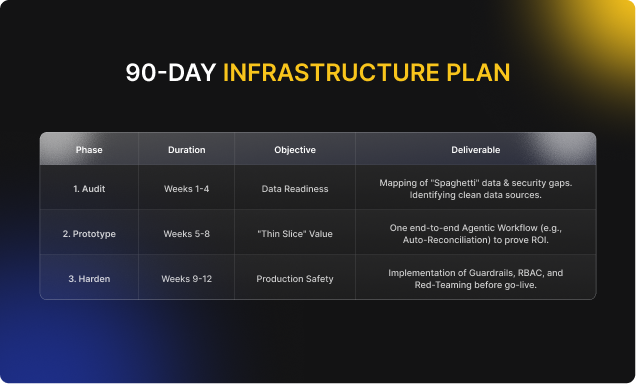

Execution Roadmap: The 90-Day Infrastructure Plan

Strategy is vital, but deployment is the bottleneck. Here is a structured path to move from Zero to Production.

Partnering for Success

Upgrading financial infrastructure requires a partner who speaks both COBOL and Python. It requires a team that understands the difference between a "demo" and a "deployment."

If your institution is evaluating the transition to Agentic AI, the first step is an architecture assessment.

Ready to audit your architecture?

https://www.thewitslab.com/contact-us with our Lead Systems Architect. We will provide a candid assessment of your current stack and a roadmap for secure integration.

If your institution is evaluating the transition to Agentic AI, the first step is an architecture assessment.

Ready to audit your architecture?

https://www.thewitslab.com/contact-us with our Lead Systems Architect. We will provide a candid assessment of your current stack and a roadmap for secure integration.

FAQs

1. What is Agentic AI in Finance?

Agentic AI in finance refers to autonomous AI systems that can plan, reason, and execute multi-step workflows such as processing a loan or reconciling a ledger with minimal human intervention. Unlike traditional chatbots that only retrieve information, agentic AI uses software tools to perform actions.

2. Is Agentic AI safe for banking transactions?

Yes, but only if implemented with Human-in-the-Loop (HITL) governance. We design systems where the AI handles low-risk tasks autonomously but requires human approval for high-value or high-risk transactions.

3. How long does it take to see ROI?

While full enterprise transformation takes years, specific workflows like Document Processing or Customer Support Automation typically show ROI within 6 months through reduced manual labor costs and increased throughput.

4. Can we integrate AI without replacing our legacy core?

Absolutely. This is the preferred approach for most established banks. We build API Wrappers that allow modern AI to talk to legacy systems without requiring a risky and expensive "rip and replace" of your core banking software.

Written by / Author

Manasi Maheshwari

Found this useful? Share With

Top blogs

Most Read Blogs

Wits Innovation Lab is where creativity and innovation flourish. We provide the tools you need to come up with innovative solutions for today's businesses, big or small.

© 2026 Wits Innovation Lab, All rights reserved

Crafted in-house by WIL’s talented minds